الشرطة الاتحادية : تطيح بأحد تجار المخدرات وضبط بحوزته أكثر من 2 كغم من مادة الكريستال المخدرة في بغداد

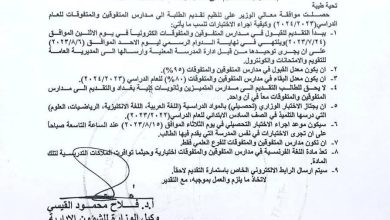

تنفيذاً لأوامر معالي وزير الداخلية السيد “عبد الامير الشمري” بمكافحة آفة المخدرات وملاحقة المروجين لها وبتوجه مباشر من السيد قائد قوات الشرطة الاتحادية ، تمكنت قوة من الفوج الاول اللواء الآلي الثالث الفرقة الآلية بالاشتراك مع الجهد الاستخباري ومفرزة من مكتب مكافحة مخدرات الكرخ وبكمين محكم في منطقة ( كفاءات السيدية ) ببغداد ، من إلقاء القبض على احد المتاجرين بالمخدرات بعد محاولته الفرار وإطلاق النار على القوة المنفذة للواجب ، حيث ضُبِطَت بحوزته أكثر من 2 كيلو غرام من مادة الكريستال المخدرة ، بندقية كلاشنكوف ، مسدس ،2 ميزان الكتروني ، أدوات تعاطي متنوعة،

تم إحالة المتهم مع المواد المضبوطة اصوليا إلى الجهات المختصة .

Live token price tracker – https://dexscreener.at/ – discover trending pairs before they pump.

On-chain Solana transaction analytics for traders and developers – this platform – monitor token flows and optimize trading strategies.